A highly manual system, the accounts payable process is riddled with places for human errors.

However, with the advent of machine learning and technologies like OCR (Optical Character Recognition), artificial intelligence has risen as an equal, if not a better match for people when it comes to entering transactions into an accounting system.

Large parts of the AP process can be streamlined using AI. This not only reduces time and labor but can optimize your accounting team and allow your core team members to focus on other, higher-value, tasks.

But what exactly do these tools do? And are they taking over human jobs or simply aiding us? Let’s find out!

What is the accounts payable process?

The AP process keeps track of invoices received, requests for payments and other cash disbursements, makes payments to vendors and suppliers, prevents penalties due to overdue invoices, and ensures an overall smooth business cycle when it comes to dealing with vendors.

AP clerks are constantly dealing with a hybrid inflow of paper and digital receipts. All of this results in several issues:

- Data Entry is a slow process – A huge part of the AP process involves importing or inputting data (such as receipts and invoices) into a centralized system, in a standardized format. This requires a large amount of manpower to go through, review and enter every bill.

- Human Unreliability – Being a repetitive and labor-intensive task leaves room open for human errors – it happens to the best of us!

- Unclear Approval Flows – Many financial requests require approvals from various departments. If this flow is not streamlined, valuable time is wasted in a waiting period. Moreover, the status of a payment or approval may not be clear either, in paper-based systems.

Despite all this, there IS a silver lining! A large part of these tasks is repetitive in nature – which makes it ideal for artificial intelligence to take on.

How is AI and automation being used in an accounts payable process?

To understand how AI can intervene, let’s look at the 4 major steps that an accounts payable process entails:

- Create Purchase Order (PO)

- Data Entry and Coding

- Invoice Verification

- Reviewing and Processing

An additional 5th step would entail reporting the process. AI can aid in these steps by automating certain parts such as:

1) Automate the Manual Data Entry Process

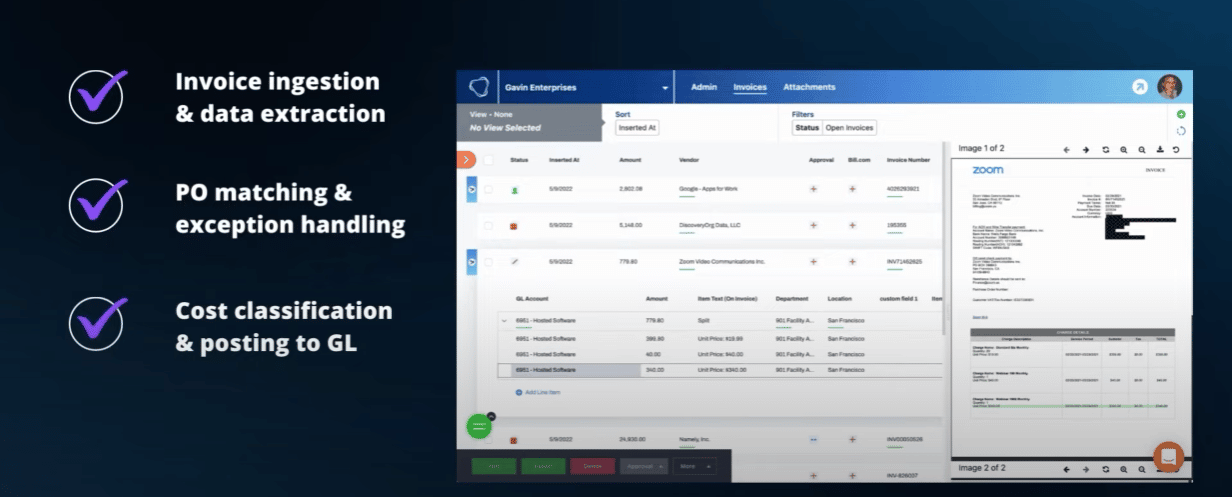

A major task done by the AP team is to input all invoices into a centralized system. This includes line-by-line manual data entry into the respective key fields.

A highly time-consuming job – this can now be done in minutes by an AP Automation tool.

All you need to do is simply upload clear receipt photos into the AI software. The software will then extract line-by-line data (including the correct field they belong to) and input it into the accounting system.

Some tools, like Bill.com’s Intelligent Virtual Assistant (IVA), provide a side-by-side comparison of the invoice and the extracted fields (in case you’re looking for discrepancies). Others like Vic.ai simply rate their capture with a low confidence score to be checked manually later. While human intervention is still needed in some cases, Beanworks claims their tool offers a 99% accuracy for data capture. Their AI tool also reduces data entry time by 83%.

AI is still a growing field, that people are only learning to trust. Various checks and balances are built into these tools to prevent errors, rather than correct them later.

For example – for unidentifiable data or duplicate entries, IVA leaves the field blank and asks for human assistance. Talk about a reversal of roles!

2) Quick PO Matching

Three-way matching is an essential step before paying off an invoice. Tools such as Vic.ai provide intelligent matching between the purchase order, supplier’s invoice, and delivery receipt.

If you ever had to complete a 3-way match, you know how painful it can be. Some POs and invoices with hundreds of inventory lines can take time to match and are prone to error.

In fact, you can actually choose to delegate the entire PO matching task to the AI itself, allowing it to determine the appropriate workflow based on the scenario, and only flag those exceptions that require human intervention.

3) Smoother and Automated Approval Flows

Software can make approval processes easier by self-launching approval flows for requests or payments that exceed a given limit.

One can set up predefined, hierarchy-based flows for different approval types. With a centralized accounting system, it’s easy for different stakeholders to signal approval or rejection in a singular dashboard, without signing multiple paperwork or emails.

There is also total visibility during the process, which means identifying points of stagnation is easier.

When you leverage software in your accounts payable process, there are other ancillary benefits such as:

Report Generation and Reminders

With all data already in the system, generating monthly reports is simply a one-click process. Moreover, unlike humans – the software never forgets. You can sign up for weekly, monthly, or quarterly overview reports based on a set format.

Similarly, you can also set reminders for conducting payment, or notify people through emails when their approval on a flow is pending.

Integrations

Already have a billing system in place? Or perhaps your company uses a different tool for resource planning?

Using APIs and integrations, you can easily share and sync data across these tools. What it results in is a singular dashboard wherein you can request payments, make payments, and grant approvals.

For example, entries made into separate accounting software can be synced onto the AP system in real-time, ensuring that all your reports remain up to date!

What are the benefits of AI in the AP Automation Process?

Apart from directly reducing the time involved in these tasks, other benefits of artificial intelligence include:

- Streamline processes, ensuring vendors get paid on time

- Saves on personnel needed and ultimately costs

- Prevents manual errors

- Provides one central repository for all documents

- Prevents overdue fees with timely reminders

- Keeps company cashflow in check with automated reports

And also creates a paperless, greener environment!

Conclusion

While AI can take over large parts of the process – it cannot fully replace AP clerks, yet. In fact, AI tools can use intelligent data to reduce manual steps and identify errors. They can remind you to conduct tasks, or send notifications asking for your approval.

But the ultimate control and final verification rest within the person in charge. Tools cannot make decisions on their own.

However, they can do smart things – like extracting the relevant fields from an invoice and posting it to the system and only flagging those exceptions that require human intervention!

You can get various Accounts Payable AI tools tailored to your company size and needs, along with a free trial. Let AI take over the basics of your accounting and give your company the efficiency it needs to grow.