Computers and software have revolutionized the audit and assurance industry over the past twenty years. From eliminating hard-copy documents to using excel for complex calculations, auditors and accountants have benefited from huge advances in technology.

Auditors and accountants are increasingly turning to artificial intelligence (AI) to help streamline the audit process and improve efficiency. AI can be used in several ways in audits, from identifying potential areas of risk to automating repetitive tasks.

Using AI in audits can help identify potential risks more quickly and efficiently. For example, if an auditor is reviewing a large number of financial documents, AI can be used to scan for key terms and flag any unusual patterns. This can help save time and improve the accuracy of the audit.

AI can also be used to automate repetitive tasks, such as data entry. This can free up audit staff to focus on more complex tasks, such as analyzing data and identifying potential risks. Automating repetitive tasks can also help improve the accuracy of the audit, as there is less chance of human error.

Overall, using AI in audits can help improve efficiency and accuracy. This can ultimately lead to better decision-making and a more efficient audit process.

What is an Audit?

An audit is an independent, objective assessment of an organization’s financial statements and accompanying disclosures. The purpose of an audit is to provide a reasonable level of assurance that the financial statements are free from material misstatement and are prepared in accordance with generally accepted accounting principles.

Audits are performed by qualified accountants called auditors. Auditors may be employed by the organization being audited (internal audit) or may be engaged from outside the organization (external audit).

The auditor’s opinion on the financial statements is issued in a report. The audit report will state whether the financial statements are prepared in accordance with generally accepted accounting principles and whether they are free from material misstatement.

Audits are conducted annually but may be conducted more frequently if there are significant changes within the organization or if the auditor believes that more frequent audits are necessary.

Types of Audits

Generally, companies conduct three types of audits: Currently, companies conduct 3 types of audits:

- Internal

- External, and

- Compliance (i.e. determining if the company complies with certain internally or externally imposed regulations or guidelines)

External audits are typically performed by accounting firms that specialize in audit services. Internal audits are typically performed by employees of the organization, but may also be performed by external contractors. Compliance audits may be done by either external or internal auditors, depending on the specific regulatory requirements.

Some characteristics are common to all three types of audits:

- Large amounts of structured and unstructured data;

- Identification of anomalies between multiple sources;

- Determining and quantifying risks; and

- Procedures to calculate and opine on the correctness of the statements.

These characteristics make auditing an ideal use case for AI. Let’s take a look at some of these use cases.

Sampling and using Machine Learning to identify high-risk transactions

Currently, auditors rely on sampling in audits and only review a small percentage of documents and transactions. Sampling in itself comes with its own set of risks! What if we miss the one sample that had an error?

With AI, such sampling could soon be a thing of the past. Optical character recognition (OCR), pattern identification, and data matching when used together, can be used to scan hundreds of documents in a fraction of the time it would take an auditor!

With Machine Learning, an AI system can be “taught” how to scan all transactions and find those transactions with a high likelihood of discrepancies or errors.

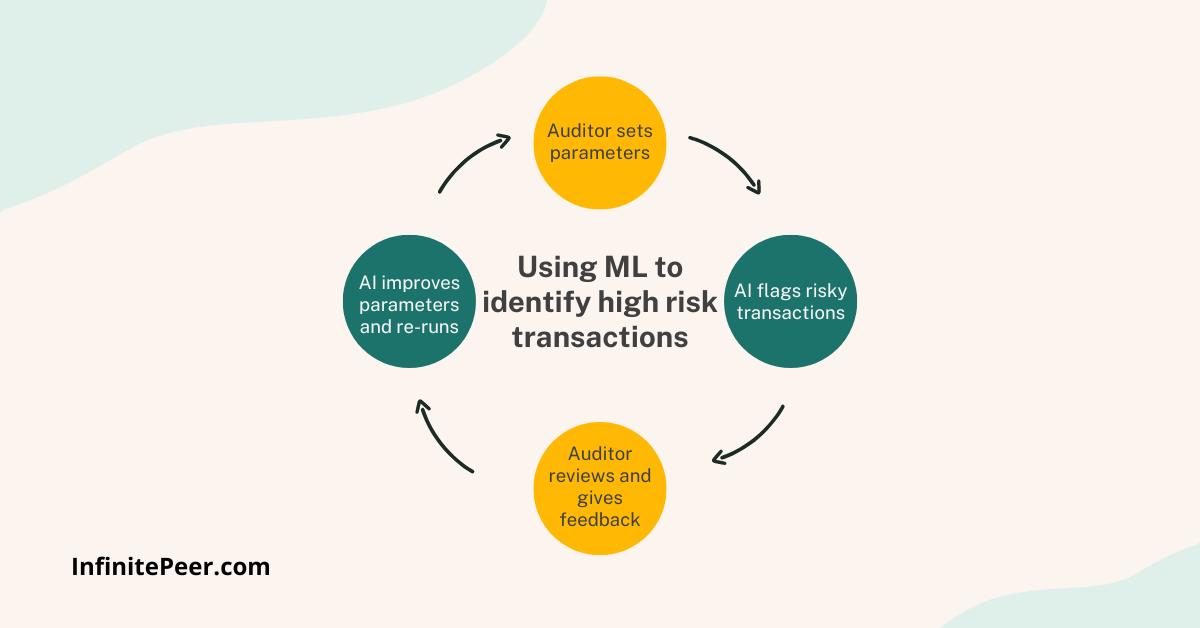

A simple teaching process using ML would be as follows:

- Step 1: The auditor sets specific parameters for transactions. The AI scans the given data with these parameters in mind and identifies anomalies.

- Step 2: Based on the parameters, the AI will segregate potential flags into segments that need more or less attention.

- Step 3: The auditor then manually reviews these and provides inputs. The AI uses these inputs to further refine its model, continuously ‘learning’ from the auditor’s feedback to make the risk assessment better each time.

- Step 4: Eventually, AI can develop its own set of parameters, such as what constitutes a high-risk transaction, and flag them more efficiently.

Instead of random sampling, an initial review of 100% of transactions can be run to identify the riskiest transactions to review in detail and obtain source documents for.

This allows auditors to focus their time and energy on areas that need human judgment, instead of relying on random sampling to find discrepancies. Once the initial time investment in AI is done, it can be a pretty self-sufficient model!

Scanning Transactions, Reviewing Data and Reconciling Documents:

A significant amount of time is spent by auditors reviewing and matching data from multiple sources, ensuring it reconciles.

OCR or Optical character recognition allows AI systems to read “paper” text from a variety of sources. With ML, they can identify the standard process for different transactions and identify if there is a change in process or error.

Using a combination of OCR and machine learning, an initial scan or review of documents can be done by AI, with anomalies flagged for the auditor. The auditor then reviews only those documents that have anomalies or issues identified.

After flagging, the auditor can manually go through the data and further add feedback to the AI for continuous performance improvement.

Developing Estimates

Developing estimates in audits is yet another area where machine learning can be leveraged. Generating estimates usually requires extensive knowledge of past processes and is one of the most complex areas of audits. Examples of estimates include the likelihood of default (and the amount that will be lost if a default happens), and the value of unique assets like businesses, trademarks, and works of art.

Using the default example, AI software can be fed with historical data ranging from the customer’s credit rating, borrowing history, and interest rate. Using this data, the software can make an estimate of the likelihood of default. In this example, the estimate developed by the software will be heavily reliant on the inputs the auditors provide, but through machine learning and continuous inputs, the software learns and improves its models over time.

While high-risk estimates still need an auditor’s intervention, a machine-learning-based model can take care of less risky estimates and eventually some higher risk areas, whether it is payroll or accruals.

Benefits of Using AI in Audits

Many companies currently offer automated audit solutions. AI tools that combine data science and machine learning are becoming more and more mainstream. With these, the benefits are many. Including:

- Reducing the overall audit risk: using AI to scan 100% of transactions is a significant improvement compared to sampling only a small number of transactions.

- Reducing the mental load for auditors: allowing auditors to spend the most time and energy on the highest risk areas that need their intervention.

- Reducing the chances of error in repetitive documentation work.

- Reducing the overall operational cost as AI cuts down on hours of work required from human auditors

- Offer better quality predictions and estimates with machine learning that is constantly improving.

Conclusion

It’s not impossible to imagine a future where ongoing auditing of all transactions in a company becomes the norm. Not only would this make financial statements much more accurate, but would give auditors and accountants the ability to identify trends early and make business decisions quickly. In the future, auditors will likely be equal parts accountants and data scientists, as AI tools become more prevalent in the industry.