AI has come to the accounting profession in a big way, with some estimating that it could replace up to 3 million jobs over the next few years.

Software that can analyze documents and identify important information, algorithms that automatically do your taxes, and automated account reconciliations are just the start of artificial intelligence in accounting.

But what does this mean for accountants? How should we adapt? How can we use AI to make our accounting more accurate and our teams more effective?

These are some of the questions we will tackle in this guide to using artificial intelligence in accounting.

What are the different types of accountants and what do they do?

Before we dive into the different artificial intelligence tools available for accountants, let’s go over the basics of what an accountant actually does.

Note: If you’re an experienced accountant, feel free to skip over this section.

Accounting is a broad term that covers many roles and responsibilities. These roles and responsibilities change depending on the size of the company and the industry.

At a high level, the most common roles within an organization are:

- Bookkeepers are responsible for full-cycle accounting, including entering transactional data into an accounting system. At a small company, they may be the only accountant, managing invoicing and accounts receivable, bills and accounts payable, tax filings, and payroll.

- Controllers are also responsible for full-cycle accounting and are typically found in larger organizations (>$5 million of revenue). A controller may have a team of junior accountants or bookkeepers entering data. The controller’s role is focused on oversight and monthly reporting, ensuring that the month-end close process is completed on time.

- Chief Financial Officers (CFO) are responsible for all financial oversight within larger organizations (>$25 million of revenue). CFOs typically have a full team under them, including a controller, many accountants, and financial analysts. Other responsibilities falling into a CFO’s role include reviewing financial statements (typically prepared by more junior team members), budgeting, forecasting, and strategic planning.

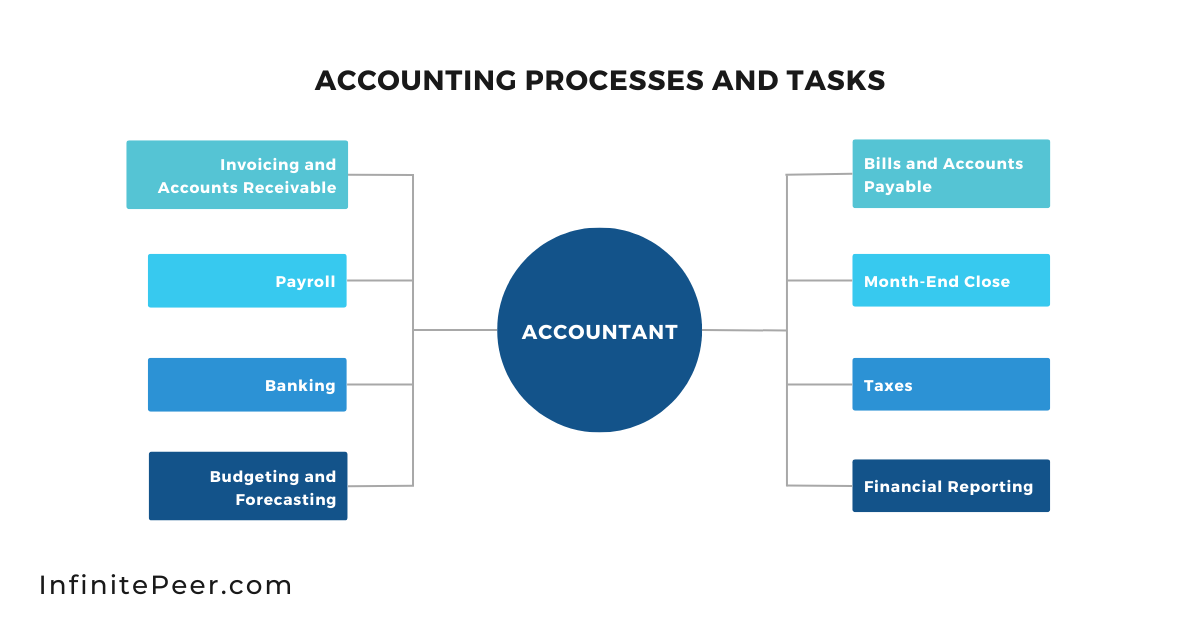

Generally, accounting processes and tasks can be broken down into the following buckets:

| Tasks and Processes | Description |

| Invoicing and Accounts Receivable | Preparing invoices for customers, collecting payments, depositing cash/cheques in bank |

| Bills and Accounts Payable | Receiving vendor bills, making payments |

| Payroll | Paying employees and related taxes |

| Month-End Close | Ensuring all transactions for the month are entered, calculating and booking adjusting entries |

| Financial Reporting | Preparing financial statements (monthly, quarterly or annually), comparing actual reports to budgets |

| Taxes | Tax compliance, tax preparation, tax filings |

| Budgeting, Forecasting and Monitoring | Preparing financial forecasts for future periods, monitoring cash flows and working capital, strategic planning |

The latest innovations in accounting software have drastically changed how accountants go about their day-to-day lives and the workflows required to accomplish their tasks.

Before we dive into the latest in AI tools, let’s discuss how software has specifically changed the profession.

How has software modernized the accounting profession?

Accounting software and systems are now ubiquitous and have dramatically changed the way accountants work.

Gone are the days of paper receipts or anything paper within an accounting department. Many companies have completely modernized their accounting processes and systems so that all documentation is retained digitally. So long printers!

This modernization of accounting systems and processes saves accountants A LOT of time. These systems have introduced automation and now AI is introducing technologies that are replacing human intervention in accounting systems.

How have accounting software like QuickBooks Online, Xero, Dynamics 365, Netsuite, and the hundreds of tools that integrate with them, impacted the profession?

- 80-90% of time spent on repetitive data entry is now automated.

- Manual errors are reduced due to improved accuracy of the information entered.

- Transparency and controls are stronger, most specifically through improved audit trails.

- Real-time reporting is becoming more prevalent and accurate.

- More sophisticated reporting capabilities allow for better financial analysis and forecasting.

Accountants can now focus more time on value-added deliverables: analyzing and turning the numbers into valuable insights that can be used for decision-making by a company’s leaders.

The Invisible Accountant: The Future of AI for Accountants

Imagine spending 1 hour verifying your numbers, as opposed to 8 hours entering them.

The biggest change AI will bring to the accounting profession is major automation, which will increase the speed and accuracy of accounting processes.

You can think of AI as the invisible accountant, who mysteriously works around the clock!

How is AI solving accountants’ problems?

Many companies will tell you that on a daily basis they face several challenges within their accounting and finance processes. Let’s walk through a few of these problems and how AI can help solve them.

Problem #1: Entering transactions (e.g. bills, invoices, expenses, payroll) is time-consuming and prone to error.

Solution #1: Transactions are processed in real-time using natural language processing and OCR (Optical Character Resolution) technology, ensuring accurate data entry and allowing companies to have real-time financial reports

Problem #2: Companies are subject to fraud from various sources through their day-to-day operations.

Solution #2: Machine learning algorithms can scan through infinite amounts of data and AI software can review authorizations to flag potential fraud issues before they occur.

Problem #3: With millions of data points gathered across business functions, it is difficult to make use of this data and gather business insights.

Solution #3: AI software can process data infinitely faster than a human. AI can identify insights and trends in vast amounts of data.

Problem #4: Complying with tax requirements is time-consuming and expensive. In addition to this, the risk of non-compliance is costly.

Solution #4: AI-enabled software can leverage NLP to scan through documents to flag suspicious or high-risk transactions requiring further action.

Problem #5: It is difficult to constantly monitor whether all employees are always following processes.

Solution #5: AI can enforce adherence to company policies and identify instances of non-compliance. As an example, AI can scan documents, credit card transactions, or even non-financial data like travel bookings, to ensure that the transaction aligns with company policy.

Problem #6: Auditing financial transactions is time-consuming. Accountants randomly select samples of transactions to review which in some circumstances provide little assurance.

Solution #6: AI can audit 100% of a company’s transactions thus reducing the reliance on statistical sampling.

Later in this guide, we’ll walk through specific use cases to illustrate how AI tools are transforming the accounting profession.

But first, let’s discuss how OCR technology works, since it is the basis of many of these programs.

OCR Technology – The basis for many AI innovations

Many of the innovations in AI tools for accountants use OCR (Optical Character Recognition), one of the earliest forms of AI.

OCR scans images of text and recognizes letters, words, or numbers. This makes it possible to take a scanned image or scanned PDF and automatically extract characters without having to manually type them.

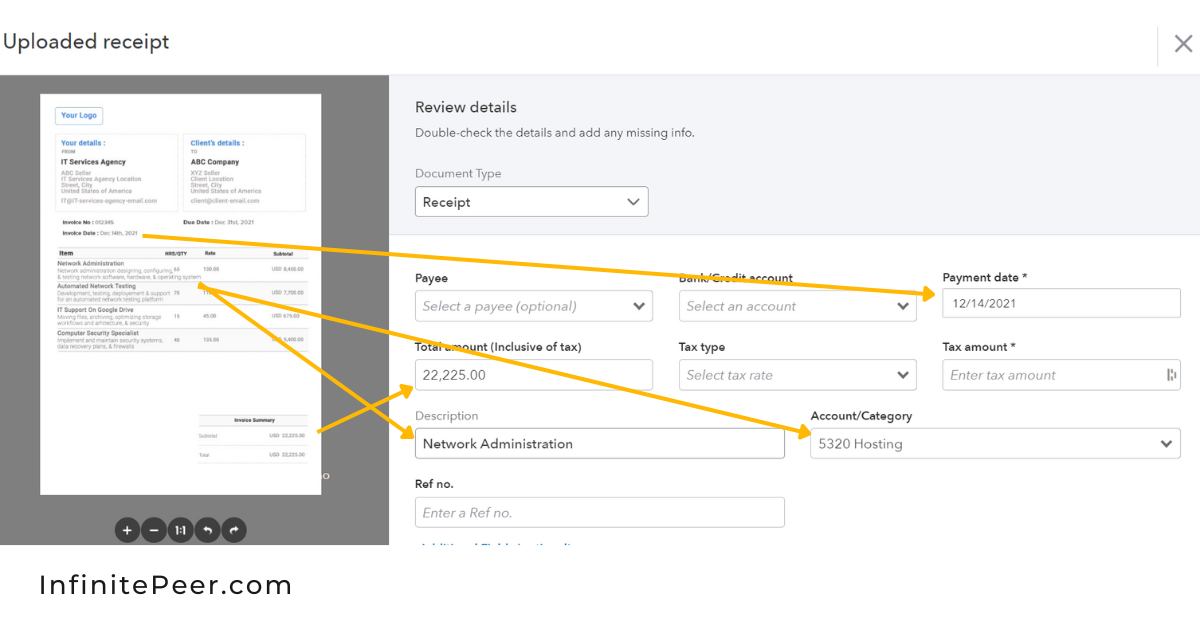

Given accountants work with so many documents, OCR technology allows for the quick processing of large volumes of documents, because the software extracts the relevant information, whether that is a bill number, item names, quantities, descriptions, and even sales taxes for you. In the past this would have been done manually by a human accountant.

The first use case below shows how well OCR works to automate some accounting tasks.

Use Case Spotlight

Artificial Intelligence in Accounts Payable

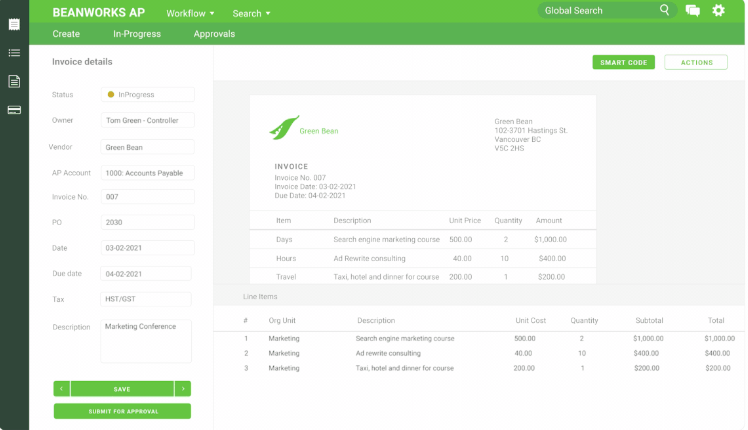

Companies like Vic.ai, Docyt, Dokka, Quadient AP (Formerly Beanworks), and Bill.com have introduced significant AI advances in the accounts payable process, increasing efficiency, accuracy, and speed.

These tools leverage OCR to extract key information from PDFs or images.

As seen in the image below, Quadient AP (Beanworks) can also ingest and classify bills so that they are routed to the appropriate approver, without any human intervention.

Each time you correct the information that has been extracted, the tool becomes “smarter” and increases its accuracy as it learns your business.

These tools cover the full AP process including purchase orders, expense management, payments, and bookkeeping automation.

Artificial Intelligence in Tax Compliance

As large companies have thousands of transactions each week, it is time-consuming for accounting teams to manually review each one to ensure that they are 100% compliant with tax laws and legislations, and are recorded correctly.

Further complicating this is that there are ever-changing tax rules and companies must comply with rules in multiple jurisdictions.

Blue Dot’s tax software harnesses NLP and Deep Learning to create an end-to-end solution for tax compliance.

This includes:

- Analyzing all your VAT-eligible spending to ensure that you capture all potential VAT recovery.

- Reviewing 100% of payments to employees to ensure compliance with taxable benefits.

- Analyzing transactions that are subject to corporate income tax and ensuring they are appropriately classified as deductible or not.

Artificial Intelligence to Provide Key Insights

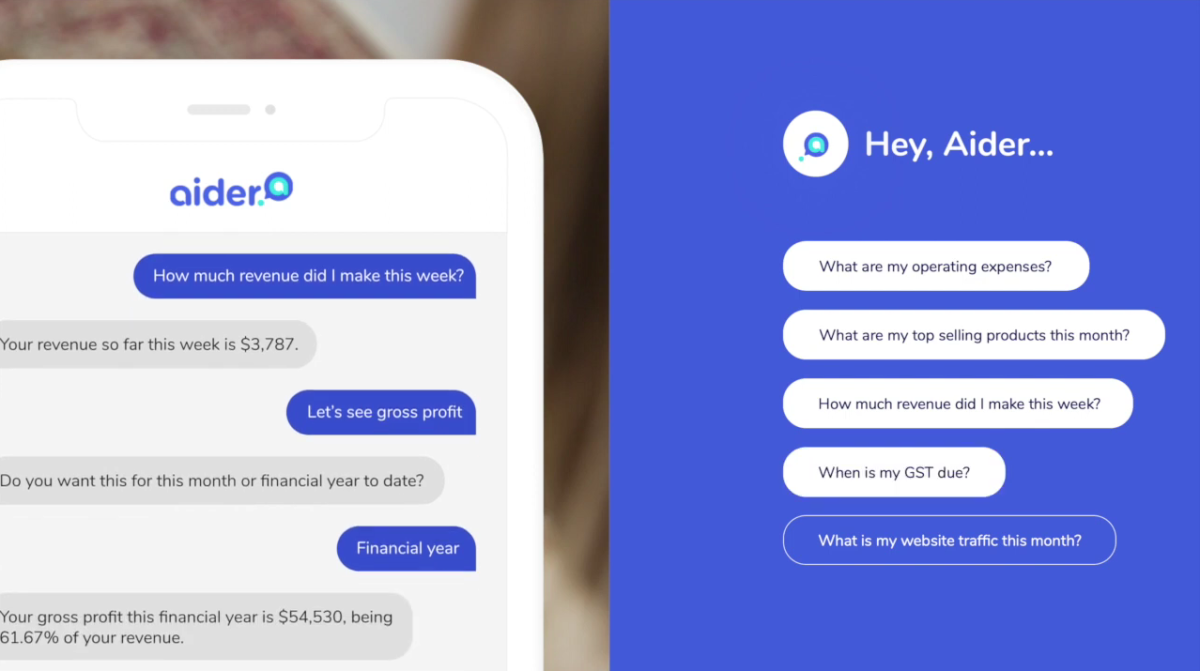

Not sure what your operating expenses were last month? Looking to find a list of invoices due at the end of the week?

With accounting data across many platforms, artificial intelligence can be used to consolidate data across platforms and provide key insights, in a central report or dashboard.

Aider.ai is a platform that connects to your accounting system and allows you to ‘communicate with your data’ by asking questions and receiving responses in return. Aider.ai learns from you and provides predictive insights, allowing business owners and their advisors to make smarter business decisions.

Artificial Intelligence to Audit

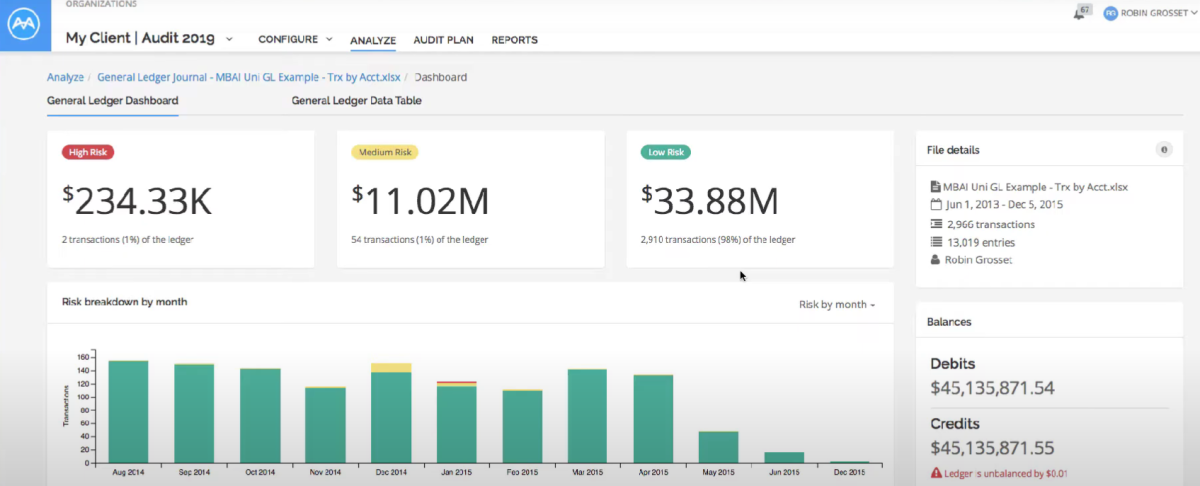

Companies like MindBridge and Kira Systems are used by auditors to provide an unparalleled level of assurance during audits.

Any auditor can attest to the pain and challenges of developing audit procedures, sampling transactions, testing internal controls, and reviewing transactions. Even with a lot of (human) resources, audits can take months and thousands of hours to complete.

Enter Mindbridge’s Ensemble AI solution. Mindbridge developed control points that are analyzed together to assign a risk level to all of your transactions – yes, you read right: 100% of transactions!

The entirety of a company’s ERP can be loaded into the Mindbridge platform so that unusual results and trends can be extracted from a complete data set.

Will AI replace accountants?

After reading this guide and seeing how effective the invisible accountant can be, you may think that it is inevitable that AI will replace accountants.

There is consensus among experts that accounting jobs will be some of the first to be fully replaced by AI. While there is some judgment in terms of how to account for certain transactions, a lot of accounting is rule-based and black-and-white.

Not Yet.

Personally, I think we are not there yet. It is still unclear how long it will take for AI tools to truly replicate everything accountants do. It’s still not yet proven that AI can replace all tasks an accountant does.

That being said, I think there is some truth to the idea of AI replacing accountants and that those fears are not completely unfounded.

I would bet in the near future that we will see 99% of accounting transactions completely automated using AI, with a higher degree of accuracy.

Will this replace a lot of jobs? Most likely. Especially those jobs focused on process-driven or repetitive tasks.

Accountants Need to Adapt.

Accountants will need to adapt, learn the capabilities of AI, and develop soft skills around communication, strategic analysis, and leadership. A professional with solid knowledge of what AI software does and does not do will always have his/her place.

The accountants of the future must be “tech-savvy” and be capable of navigating the software ecosystem to implement and integrate various tools automating their workflows and processes.

The hardest skill for AI to develop is one of adding trust and a human element to decision-making. While it may be able to translate data and numbers into insights, we still need professionals to take those insights, turn them into decisions and communicate them to their clients or stakeholders… at least as of today!

In the meantime, the integration of technology into accounting provides automation and efficiency at a low cost and should be leveraged by accountants to control costs and achieve higher levels of accuracy in financial reporting.